Homeowners Insurance in and around Gilbert

Gilbert, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

It's so good to be home, especially when your home is protected by State Farm. You never have to be anxious about the unanticipated with this outstanding insurance.

Gilbert, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Why Homeowners In Gilbert Choose State Farm

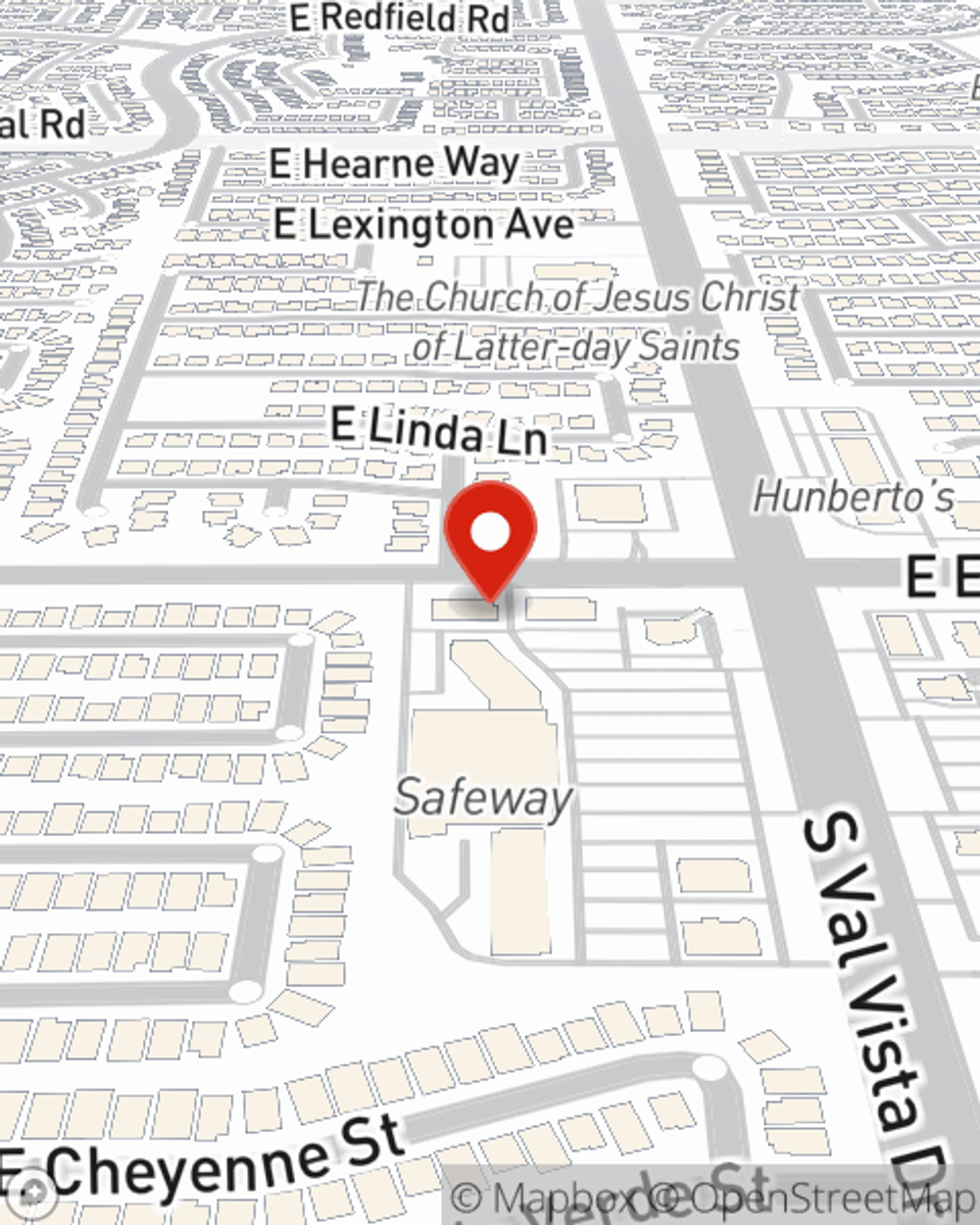

State Farm Agent Lisa McCain is ready to help you handle the unexpected with excellent coverage for your home insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Lisa McCain can help you submit your claim. Find your home sweet home with State Farm!

Ready for some help exploring your specific homeowners coverage options? Call or email agent Lisa McCain's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Lisa at (480) 855-8293 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

Lisa McCain

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.